UK inflation data out this morning delivered a modest beat, though it remains tracking below the BoE’s August forecasts.

Headline CPI inflation for September showed price growth of 6.7% YoY, flat on last month’s print but modestly exceeding pre-release consensus that looked for a 0.1pp fall. Even so, with the overshoot largely attributable to a rise in motor fuel costs and signs that underlying price growth continues to ease, today’s release is unlikely to change any minds on Threadneedle Street. In our view, policymakers have set a high bar to restart policy tightening with their recent communications, and this morning’s data does not pass that threshold.

Moreover, with a large fall in next month’s release in hand due to last October’s rise in the energy price cap, we expect the MPC will feel comfortable holding Bank Rate at 5.25% in November.

Looking through today’s release, food and non-alcoholic beverages continue to contribute the largest contribution to the annual inflation rate at 1.42pp, with prices growing by 12.1% YoY. However, this eased once again from 13.6% in August, with prices actually recording a 0.2% fall MoM. The other volatile component of the CPI basket, energy costs, barely changed in September MoM too. Although on an annualised basis they continue to provide a significant upwards contribution to headline CPI, this will drop mechanically next month as a 25% increase in the Electricity, gas and other fuels component due to a rise in the energy price cap last October drops out of the consumption basket.

Transport inflation prevented headline inflation for cooling, but this was mainly a story of higher motor fuels

Despite falling by 0.22% on the month, it was notable that transport provided the largest upwards contribution to year-on-year inflation on the month at 0.17 percentage points. This largely explains the upwards surprise in the headline rate and why it printed flat on the month at 6.7% YoY. This was primarily a story of base effects and motor fuel inflation, however. Last year, transport inflation fell by 1.5% MoM, meaning the more moderate reduction this September resulted in an uptick in the annual figure from -0.5% YoY in August to 0.7% in September. Dialling into the details even further, the story becomes even narrower as transport services fell -6.4% MoM. Although this was largely driven by a 23.3% reduction in airfares, it shouldn’t take away from the fact that all other components of transport services saw moderate disinflation or negligible price increases on the month. For reference, the largest increase came in bus and coach fares, which rose 0.3% MoM.

Instead, motor fuel prices provided all of the inflation on the month, with the price of petrol rising 5.1p per litre (3.36% MoM) and diesel by 6.3p per litre (4.19% MoM).

Given oil benchmarks have fallen from their September peaks and the continued uptrend has been broken, we expect prices at the pump to be stable in October, leaving transport inflation at the mercy of transport services inflation. However, the ongoing conflict in the Middle East and the upside risk it presents to oil and distillates means we take little conviction in this call this early on in the month.

Removing the effects of volatile components, the inflation story isn’t that concerning

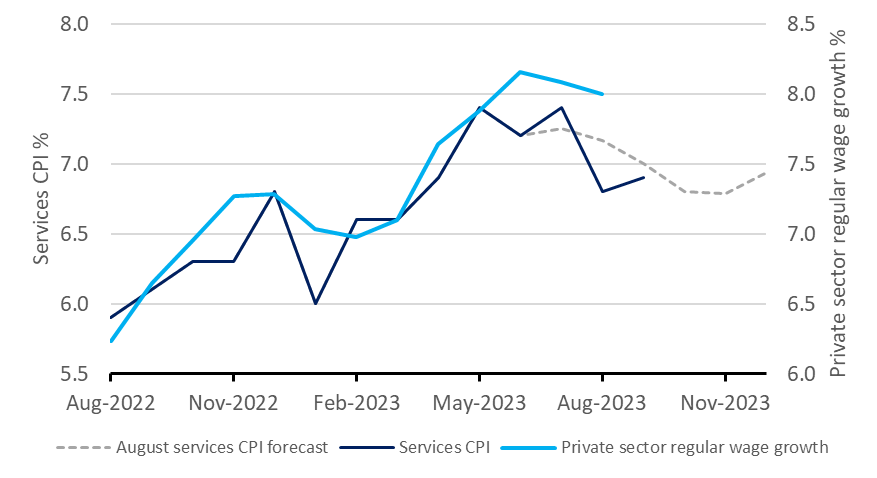

Stripping out the impact of volatile components, core inflation showed some easing, dropping from 6.2% to 6.1% YoY, though this still overshot economist expectations for a 0.2pp fall. Indeed, services CPI actually rose from 6.8% to 6.9%, though this remains below the 7.0% YoY growth predicted by the Bank of England in the August MPR. This was notably led by wage sensitive sectors including Restaurants and Hotels, and Recreation and Culture, where prices grew by 0.7%, and 0.8% MoM respectively. Given the continued persistence of wage growth, which whilst easing once again in August continues to track at 8.0% based on the official August measure of private sector regular pay, continued inflationary pressures in these sectors are perhaps unsurprising. Notably though, indications from more forward looking indicators such as the S&P PMIs suggest a weakening pass through from wage increases to price charged as firms opt to absorb higher costs in their profit margins to maintain revenues in the face of slowing consumer demand. Given this, policymakers are unlikely to panic in response to today’s release, with good reason to believe easing price growth should show up in these sectors over coming months.

Services CPI rose in September, but continues to print below BoE forecasts

In our view, with today’s beat attributable to a combination of volatile components outside of policymakers control and wage sensitive sectors, where future disinflation can be expected, there is little to indicate a need for further policy tightening from the BoE.

Markets appear to be of a similar view that today’s data has done little to change the narrative for BoE policy tightening. Expectations for Bank Rate ticked up only marginally, most likely due to the beat in the headline measures in isolation, but continue to see a roughly 25% chance of a rate rise in November and just over a 50% chance that the MPC chooses to raise rates once more this cycle. Similarly in FX markets, whilst sterling initially rose 0.25pp as the headline landed, this move has since partially retraced as the detail of the report became apparent.

Authors:

Simon Harvey, Head of FX Analysis

Nick Rees, FX Market Analyst

Login

Login